China's Trade Report Registers Decline – Global Trade Recession

China is one of the biggest trading nation in the world and assists multiple national economies to fulfill their demands. Recently the trade records of China are falling, hence causing problems for various other nations.

INTRODUCTION

China's trade data has long been a barometer of Global Economic Health. As the world's second-largest economy and a major player in international trade, China's import and export trends provide crucial insights into global commerce.

China's trade data is more than just numbers on a spreadsheet; it is a reflection of the nation's economic health, trade relationships, and global supply chain dynamics. Understanding this data allows economists, policymakers, and businesses to gauge the country's economic performance, identify emerging trends, and make informed decisions.

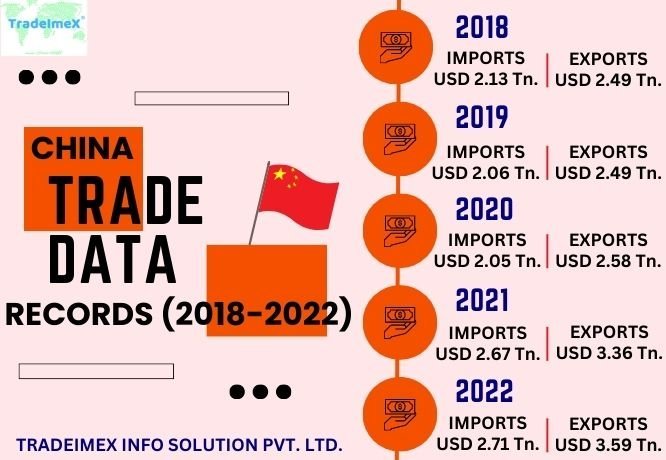

Below mentioned are the past years’ trends of China as per China Trade Data records.

|

CHINA TRADE DATA RECORDS – 2018 TO 2022 |

||

|

YEAR |

IMPORTS |

EXPORTS |

|

2018 |

USD 2.13 Trillion |

USD 2.49 Trillion |

|

2019 |

USD 2.06 Trillion |

USD 2.49 Trillion |

|

2020 |

USD 2.05 Trillion |

USD 2.58 Trillion |

|

2021 |

USD 2.67 Trillion |

USD 3.36 Trillion |

|

2022 |

USD 2.71 Trillion |

USD 3.59 Trillion |

---------

DROP IN CHINA’S IMPORT AND EXPORT VALUES

The ebb and flow of a nation's imports and exports often mirror the intricate dance of its economy. China, a global economic giant, has experienced fluctuations in its import and export figures that send ripples across global markets.

As per nation’s Import Export datasets, the exports from China fell by approximately 14.5% in July 2023 as compared to July 2022. Whereas, in the same time duration, imports to China also showed negative trend in the year 2023 with reduction in total imports by 12.4%. This massive deviation that was observed in China’s market was because of the falling domestic demand. This weakened demand shook the 2nd largest economy of the world and heightened the pressure of nation’s distinguished authorities to release fresh stimulus for boosting and maintaining the growth.

According to fresh China Export Data insights, the nation’s exports to the United States fell steeply by 23.1% in the month of July 2023, as compared to July 2022. On the other hand, exports of China to the European Union also reduced by 21.4% as compared to previous year. Likewise, imports to China from Russia registered a decline by 8.1%. It would be irrationality if we only blame China’s trade insights and demand trends alone as ongoings in other nations has also impacted the smooth flow of goods to and from China. For instance, heated national issues between Russia and Ukraine, or the collapse of the United States economy.

Let us now try to learn that which industries are majorly affected due to this retarded trade insights.

- The first industry that is hit hard is related to crude oil and petroleum. The imports of these items decline by almost 20.8% in July 2023 to China as compared to July 2022.

- Industry of integrated circuits has also experienced a decline of 17% as major imports to China.

- Bilateral trade to and from China of automobile and light motor vehicles have also started experiencing decline and retarded growth.

---------

IMPLICATIONS OF RETARDED TRADE ON CHINA’S ECONOMY

Adding to other troubles and hurdles for China, retarded trade growth is a new addon to the problems, hence promoting slow growth even more.

As mentioned above that imports as well as exports to and from China reduced by 14.5% and 12.4% respectively in the month of July 2023 as compared to previous year, it is hence forecasted that this trend would be followed in near future as well.

As various major industries ranging from electrical, machinery, automobiles, to crude oil, and precious stones are hit hard negatively due to decreased domestic demand as well as international tensions, they need time to get back on track causing economic slowdown in the country.

Last but not the least, in order to boost trade of China, the country is experiencing deflation to encourage domestic demand to grow which will in turn help to provide mileage to China Import Data statistics.

China is also suffering from a property crisis too as one of the prominent real estate developers named “Evergrande” collapsed early this year. This is another problem with which China must fight dominantly.

---------

CONCLUSION

China's trade data decline is a complex phenomenon influenced by a confluence of domestic and international factors. As the country navigates through economic transformations, supply chain disruptions, and geopolitical tensions, its trade landscape is evolving. While the decline might raise concerns in the short term, it also presents an opportunity for China to pursue more sustainable and balanced growth, fostering domestic consumption and innovation. As the world watches and adapts to these changes, the ultimate outcome remains uncertain, with the potential to reshape the global economic landscape in unexpected ways.

For more sustainable and accurate trade insights about China, get in touch with TradeImeX as we deal in providing the most legit datasets of not only China but 70+ other nations.

--- END ---

What's Your Reaction?